Melka Case: The Financiers Behind the Oil Palm Business in Amazonian Deforested Areas

An oil palm project in the Amazonian region of Ucayali -operating across 10 thousand hectares of clear-cut forest- has been the target of investigations and questionings for 8 years. As part of the investigative series Palmas para nadie [Oil Palms for No One], Convoca.pe now reveals the identity and financial stakes of the international investors of Ocho Sur group - Peru’s second largest oil palm producer- and its relationship with the American businessman Dennis Melka, who is investigated for clear-cutting by the Specialised Prosecutor for Organised Crime in Lima.

By Gonzalo Torrico | 15 de abril del 2021

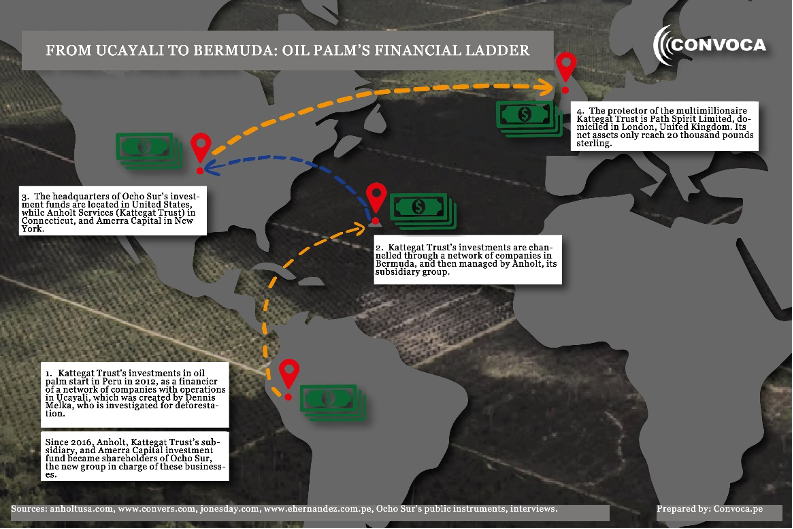

With half a century of experience navigating the seas, Danish family Karlshoej’s shipping companies has found a safe harbour to anchor its assets and diversify its business inland. From the tax haven of Bermuda, where it has incorporated a network of tax-exempt companies, it steers a diverse portfolio of global investments, including two oil palm plantations in Peru involved in the deforestation of 10 thousand hectares of Amazonian forest.

The Kattegat Trust, a “charity trust” established in Bermuda, gathers the fortune made by late Danish Torben Karlshoej through the maritime transport. Since 2012, through its subsidiary group Anholt, it has financed the operations in Peru of the American speculator Dennis Melka, who is investigated by Peruvian authorities for being allegedly responsible for mass clear-cuttings in Ucayali and Loreto during the execution of his agro-industrial plans.

After cross-checking information, Convoca.pe has been able to identify a 48-million-dollar investment linked to Anholt made in the network of companies led by Melka and channelled through a chain of companies established in Bermuda.

Since 2016, Anholt and its business partner Amerra Capital, a New York investment fund that also financed the deforestation network, have control over the same oil palm production project under a new legal mask without Melka’s face: Ocho Sur group. Its companies, Ocho Sur U and Ocho Sur P, claim to have no relation to the previous administration and, therefore, not to be responsible for the deforestation under investigation by the Public Prosecutor’s Office in the lands where they perform their operations.

To follow Ocho Sur’s financial ladder in the Peruvian Amazonia all the way to the managing company of The Kattegat Trust, it is necessary to climb at least six steps of companies to finally reach the top of the chain.

In the last four years, Convoca.pe has investigated Melka’s operations in Peru, from the incorporation of more than twenty companies for the expansion of cacao and oil palm projects in the Amazonia and the irregular acquisition of lands, to the investigations it faces at the Public Prosecutor’s Office for deforestion. Convoca.pe has also looked into Ocho Sur’s businesses - Melka group’s successor in these lands- with oil palm processing companies that sell to Alicorp, the food industry giant.

As part of the investigative series Palmas para nadie [Oil Palms for No One], we reveal the increasing interest of these plantations’ financiers, the unknown participation of Melka in the new administration of these businesses, and the legal mechanisms that have turned impunity into the most profitable asset of the Peruvian Amazonia.

The investments in these oil palm plantations in Peru are connected to Bermuda, USA and the United Kingdom.

Paper Forest

Melka landed in the Peruvian rainforest after making investments in South East Asia through Asian Plantations Ltd. in 2007. In Malaysia, he acquired 25 thousand hectares of tropical forest, obtained the funds to sow oil palm and, in 2014, sold its interest to an international oil palm giant: Felda Global Ventures.

“This was during a bad commodity cycle”, bragged Melka during a presentation for investors in London in May 2015. “Oil palm had been dropping for five years; it was a total bloodbath. We outplayed all our peers, who reported negative returns in the same period. We generated returns three times positive”, he said.

In Peru, Melka planned to replicate this low-cost, high-profit business scheme. To start the project, a network of 25 Peruvian companies was set up from 2010 to 2013 to acquire lands, among which were Plantaciones de Pucallpa and Plantaciones de Ucayali. An offshore company connected to the Cayman Islands and Singapur: United Oils Limited, was also established.

As announced in a stock-exchange report, Melka’s business network in Peru already had a strategy to acquire more land banks. It consisted in requesting state entities to privatise tropical lands to his favour.

It is known that his companies requested the awarding of 96 thousand hectares to the General Directorates of Agriculture of the regional governments of Loreto and Ucayali.

2012 was key. Plantaciones Ucayali achieved the awarding of 4,700 hectares from the government of Ucayali, while Plantaciones Pucallpa obtained 6,800 hectares after negotiating the purchase of 222 properties from individual owners. This purchase is now questioned before the Constitutional Court by the indigenous community of Santa Clara de Uchunya in Ucayali, which claims that it is part of its ancestral domain.

Álvaro Másquez, lawyer of the Legal Defence Institute defending the indigenous community, points out that they demand the annulment of the sale agreements entered into between alleged land traffickers and the Melka Group to acquire some of the lands later used for oil palm production.

“There is an element of corruption in the awarding [of lands by the regional government to individual sellers] under investigation by the Public Prosecutor’s Office and the General National Audit Office”, he stated. Indeed, the matter involves the regional government of Ucayali, which, according to the investigations by Convoca.pe, awarded “certificates of possession” for these lands without the beneficiaries demonstrating their presence in the place.

The large-scale clear-cutting in these lands began in June 2012, and they are now covered with Ocho Sur’s oil palm plantations ―current owner of the lands of both of Melka Group’s companies― as confirmed in an assessment by the Monitoring of the Andean Amazon Project, which monitors deforestation in the rainforest using satellite images.

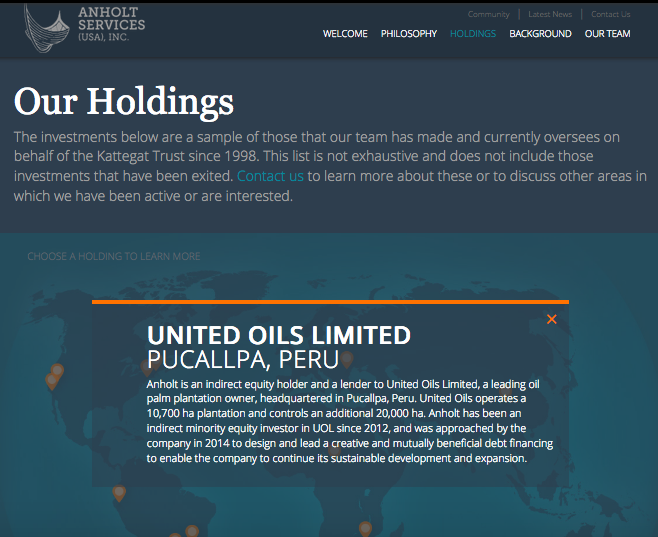

That same year, Anholt started a relationship with the Melka Group as “an indirect minority equity investor” in United Oils Limited, a company funded by this businessman under investigation, according to the information published in 2014 by American company Anholt Services USA but no longer available on its website.

“The connection that you appear to be trying to make likely stems from some shares that Anholt owned in an agriculture investment fund, that Anholt did not control. That fund owned some shares in United Oils; and that fund did not control United Oils”, responded Michael Spoor, CEO of Ocho Sur since 2019, via email after being consulted for this article. We asked which was the name of such fund, but he did not reply.

If Anholt’s equity was minor, as claimed by Spoor, it stopped being minor in 2014, when a “further investment” was announced.

Ucayali deforested for large-scale oil palm plantations by the Melka Group. Photo: Diego Pérez/Oxfam.

“[Anholt] was approached by UOL [United Oils Limited] to design a creative and mutually beneficial structure to enable the company to continue with its development and expansion”, declared the investment fund in the same publication of 2014, which was deleted from Anholt Services USA Inc.’s website when questionings on Melka’s operations in the Peruvian Amazonia arose.

The new financial operation would allow a greater flow of capital from The Kattegat Trust, through Southern Harvest Partners LP ―an Anholt subsidiary―, to the Melka Group in the shape of note purchase from United Oils Limited, a type of loan in which note holders receive a fixed return within an agreed short term.

According to the documents accessed by Convoca, everything indicates that the “creative and mutually beneficial structure” announced by Anholt in September 2014 was a stock issuance and sale agreement entered into on 23 July of that year between Dennis Melka’s United Oils Limited and an offshore company incorporated in Bermuda a week before named SH UOL Administrative Agent Ltd; the latter would later represent the “note holders”.

Who was the owner of this new company created in Bermuda? We received no answer from Anholt or Ocho Sur, but according to the registries in Bermuda, SH UOL Administrative Agent has three directors, all of them connected to The Kattegat Trust: Peter Antturi, Core Lee Starzomski and Louie Escalona Cuarentas.

How much money was injected with the note purchase? The companies did not answer this question either; however, Melka Group’s international lawyers gave us a hint through some of their statements.

A statement made in November 2014 by the well-known American law firm Jones Day, which represented United Oils Limited, highlights that they gave advice for a 28-million-dollar note issuance “to various private and institutional investors”. They added that the financing was aimed at an oil palm project in 10,700 hectares owned by United Oils.

When this money was injected, the accusation of deforestation had already been filed. One year earlier, in May 2013, CONVEAGRO -a Peruvian farmers union- reported to the Public Prosecutor’s Office that 30 employees of Melka Group’s Plantaciones de Ucayali had trespassed private and state property in the small village of Bajo Rayal (Ucayali) and deforested lands using tools and machinery.

When asked about the financing by Anholt and Amerra to these operations in Peru, Ocho Sur’s lawyer Karim Kahatt argued that “such money did not belong” to these companies. Why not? “Once the credit disbursement is made [by the investors], it belongs to United [Oils Limited]”, he replied.

To which extent did Melka’s investors know about the origin of the lands? “As I understand, the lenders [Anholt and Amerra Capital] had hired highly respected and reputable Peruvian law firms to perform legal due diligence on the assets of the borrower prior to making any loan to it”, claimed Michael Spoor, CEO of Ocho Sur.

“The due diligence performed by the Peruvian lawyers showed nothing remarkable or unusual about the origin of the titles or the titling process”, he added.

Ocho Sur’s lawyer Karim Kahatt points out that the company he represents learned through the official documents [property deeds] that they were “seized properties mostly used for agriculture for the last 30 years”.

“Now, if there was a questionable land granting, [Melka’s] Plantaciones is responsible, not Ocho Sur”, declared Kahatt. That is, it is responsibility of the former companies financed by the current shareholders of Ocho Sur.

The documents to which Convoca had access state that the agreement between Anholt and the Melka Group was internally called “UOL Note Agreement” and it could be “amended, restated or supplemented” or “modified from time to time”. This means that values and conditions could vary.

Image no longer available on the website of Anholt Services USA Inc., to which the design and management of a mutually beneficial creative financing was proposed.

United Oils’ international lawyers from the Jones Day law firm also announced the issuance of warrants for note buyers, that is, rights to eventually buy stock from United Oils. We requested an interview with the American law firm to ask for details about such operation, but there was no answer.

Were the Kattegat Trust companies the only ones participating in this 28-million-dollar injection in which its related company SH UOL Administrative Agent represented those acquiring the bonds? Neither Anholt nor Ocho Sur answered.

We insisted on requesting interviews to the email address of Amerra Capital ―the other investor that is now shareholder of Ocho Sur― to know what was its participation in the financing of the Melka Group. The New York company did not answer either.

Powerful Relations

When the criminal complaints against the Melka Group filed in 2013 reached the Judiciary, the founding shareholders of Plantaciones de Ucayali ―two lawyers from the Benites, Forno & Ugaz law firm in Lima― denied their criminal responsibility by claiming that, before the events, they had transferred their shares to an offshore company named Jonaquille Limited established in the British Virgin Islands, where the trace is lost.

What was Jonaquille Limited, the nearest company to the extinct Plantaciones de Ucayali? It is presumably an under-the-counter vehicle to control Plantaciones de Ucayali, which was still related to United Oils Limited, as the latter continued controlling the plantation and negotiating financing.

The British Virgin Islands ―where the offshore company Jonaquille was established― goes on stage once again with a new money injection in favour of United Oils Limited, which was announced by the offshore law firm Conyers Dill & Pearman in March 2015.

Conyers law firm indicated that it had given advice on laws in Cayman Islands and the British Virgin Islands to “the purchaser, note holder and security agent” in a financing scheme for United Oils Limited, issuing notes for not less than 48 million dollars. Four months before said statement, Peru’s Ministry of Agriculture had ordered the Melka Group, for the first time, to stop the operations of the now liquidated Plantaciones de Ucayali, as it had no environmental certification.

We sent a number of questions to Conyers Dill & Pearman to know who would be behind that new operation that financed Melka’s questioned project for said amount.

“We are unable to provide further information concerning United Oils Limited, as Conyers does not discuss client matters since they are confidential”, replied the law firm involved in the “Mauritius Leaks” ―the tax evasion scandal in Africa revealed by the International Consortium of Investigative Journalists (ICJ); in it, its legal advice to multinationals was made public― to Convoca.pe.

What Conyers Dill & Pearman does mention on its website is that the Hernández & Cía law firm in Lima and Dickstein Shapiro LLC’s branch in Connecticut, located 15 minutes away from the headquarters of Anholt Services USA Inc., participated in the same financing to Melka Group.

Another publication on Hernández & Cía’s website confirms that a 48-million-dollar financing ―the same amount― to United Oils Limited corresponds to a note issuance agreement signed in July 2014.

As previously mentioned in this report, a 28-million-dollar initial agreement ―that could be “modified from time to time”― between Melka’s United Oils Limited and a company linked to The Kattegat Trust and Anholt’ subsidiary SH UOL Security Agent, which represented the note holders, was announced that same month and year.

The companies and lawyers involved in these operations did not want to specify whether they are two different capital injections or the increase of an original amount. We requested an interview with an Anholt’s representative, but its vice-president, Robert Decosimo, stated that it made more sense having Michael Spoor, Ocho Sur’s CEO, as only contact. We sent our questions about Anholt’s unusual participation to both Decosimo and Spoor’s emails, but they did not answer.

The Hernández & Cía law firm did not accept our interview request either. The Dickstein Shapiro law firm, for its part, was closed down.

Deep Roots

In May 2015, the indigenous community of Santa Clara de Uchunya, in Nueva Requena, Ucayali, reported to the Public Prosecutor’s Office that the flora and fauna of the Amazonian rainforest were being destroyed with heavy machinery and ditches were dug out to bury trees and leave no evidence. The actions reported took place in the area where another Melka Group’s company, Plantaciones de Pucallpa, was settled and which is claimed by the indigenous community as ancestral domain.

“There are groundless accusations that the company has clear-cut trees in primary forests”, declared Ocho Sur’s lawyer Kahatt. “Pucallpa has motorways […]. Do you think a place that is one hour away from the city of Pucallpa had primary forests in 2013 or 2014? That’s impossible. What had grown there after farmer’s intervention were secondary forests”, he stated.

However, the Monitoring of the Andean Amazon Project maintains that most part of the deforestation performed in both plantations ―that back then belonged to Plantaciones de Ucayali and Plantaciones de Pucallpa― covered an area of 12,188 hectares, 9,040 of which (77 %) corresponded to primary forest.

Ocho Sur’s lawyer, Kahatt, is familiar with the lands’ history. When consulted by Convoca, he confirmed having met Dennis Melka in 2015 -before Ocho Sur was created- and having provided legal advice in regulatory and farming matters for his business group; for instance, on 2 September 2015, when Peru’s Ministry of Agriculture ordered Melka Group’s Plantaciones de Pucallpa to stop operations for the second time.

The Ministry confirmed that such lands had been almost totally clear-cut and farming activities were being conducted without environmental certificate once again. As a result, operations were to be stopped until the submission of an approved “land classification” by the Melka Group. Kahatt says there was a number of irregularities, one of them being that the Ministry of Agriculture had already allocated those lands to previous individual owners for farming use.

That same day the stoppage occurred, the more than 200 plots of Plantaciones de Pucallpa and Plantaciones de Ucayali became untouchable. We learned that both Melka Group’s subsidiaries signed a so-called Security Trust Agreement with SH UOL Administrative Agent ―with directors related to The Kattegat Trust― and La Fiduciaria.

Using this legal and financial mechanism, the plots went under La Fiduciaria’s management so that, should United Oils Limited fail to pay its investors by February 2016, the lands could be auctioned to collect the debt. While in the hands of La Fiduciaria, plots would not be seizable.

Kahatt claims that he gave no advice for this financial operation.

“Amerra and Anholt have been enormously affected by a manager [the Melka Group] that could not rise to the occasion”, declared Kahatt referring to his former client.

From Melka Group to Ocho Sur

Amid deforestation accusations, press revelations and Uchunya community’s requests for domain expansion in 2015, the plots were under scrutiny. In addition, the indigenous people filed a complaint against the Melka Group to the Roundtable on Sustainable Palm Oil (RSPO), an international organisation whose aim is to certify companies that produce sustainable palm oil.

It was then when the security trust was signed.

In April 2016, RSPO demanded Plantaciones de Pucallpa to stop its operations until the complaint was settled. However, a report by the Ministry of Agriculture proved that workers with tools for work and farm waste burning were in the plots of the company, which was supposed to be inoperative.

Ocho Sur says on its website that the shareholders of Plantaciones de Pucallpa and Plantaciones de Ucayali -led by Melka- stopped financing the business and the operations and failed to pay investors. Now we know Anholt and Amerra Capital were among them.

As a result, the Melka Group’s breach, as provided for by the agreement, led La Fiduciaria to schedule three rounds of public auctions to sell the plantations: on 30 June, 7 July and 14 July 2016.

The call for the auctions is still on the web. It was published in English in the Jakarta Post newspaper of Indonesia on 23 June, a week before the first auction date, demanding potential participants 17 thousand kilometres away to comply with requirements in record time.

“Interested bidders may expressly indicate interest in participating in the public auction and request the auction conditions by delivering a notary letter to Calle Los Libertadores 155, Piso No. 8, San Isidro [Lima] (…)”, the letter published in Indonesia read.

By that time, the new companies of the investors had already been incorporated and would be used to participate in the auction to obtain such lands.

“Ocho Sur P and Ocho Sur U were created back then by creditors who made the difficult decision to offer their debt amounts to buy the business and prevent the catastrophe that would have resulted from the abandonment of lands, jobs and economic activity in the plantations”, declared Spoor. “In other words, they had to play for the team”, said Kahatt.

Ocho Sur U and Ocho Sur P were already registered in the Peruvian Public Registry since May 2016, one month before the first auction. Its founding shareholders were lawyers from Hernández & Cía, the same law firm that gave advice about the trust agreement, the auctions and the transfer.

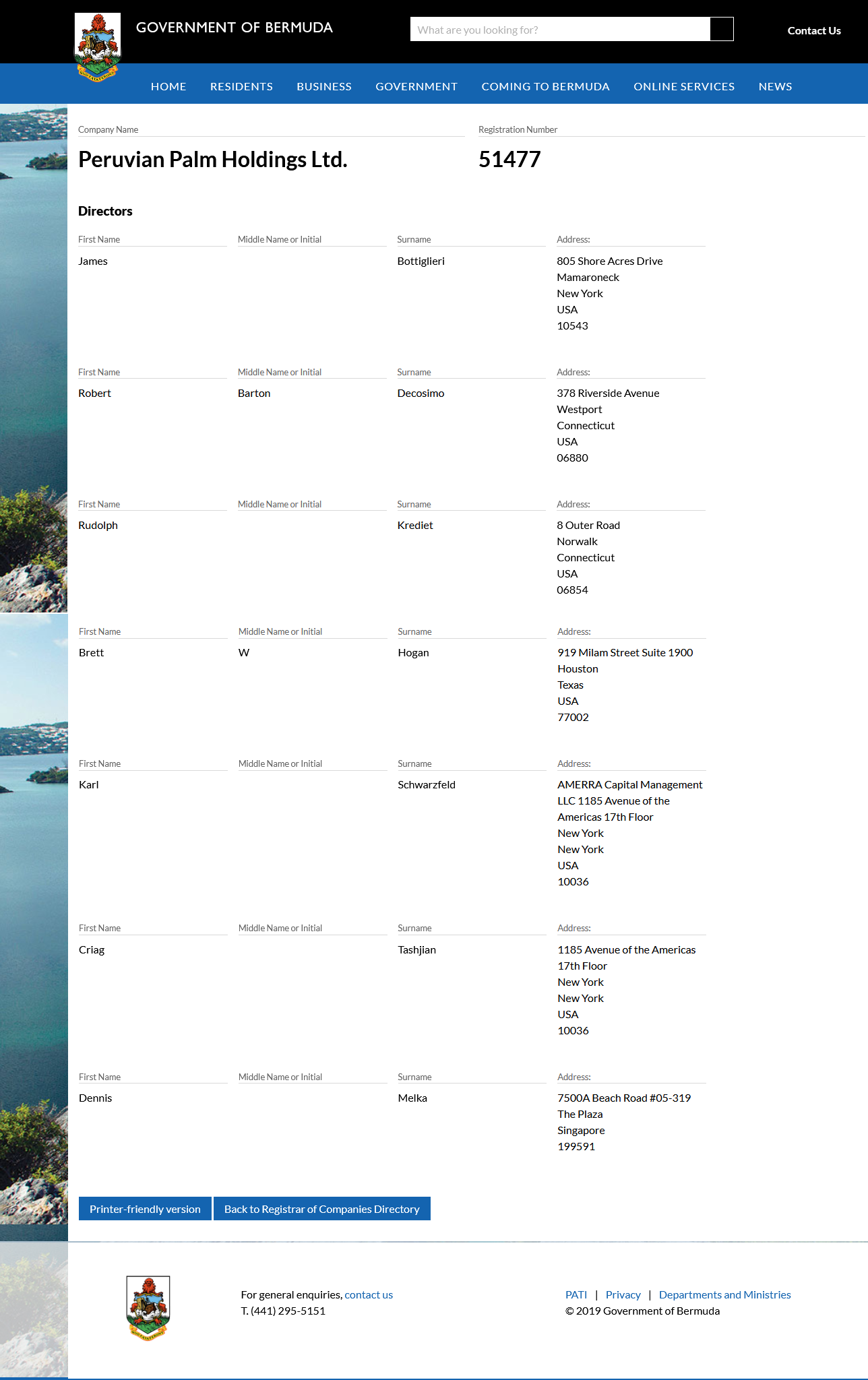

However, we could confirm that the current owner of both local companies is Peruvian Palm Holdings Limited, domiciled in Bermuda and created in May 2016. It is thus revealed by the public instruments concerning the last capital increase of Ocho Sur P and Ocho Sur U, which showed that Peruvian Palm Holdings owns, directly and indirectly, 100% of these companies.

SELLO Escrituras Públicas d... by ConvocaRedes

As confirmed by the public instruments, Peruvian Palm Holdings owns, directly and indirectly, 100% of these companies

“My understanding is that the borrower [United Oils Limited] notified its lenders in February 2016 of its inability to continue to make interest or principal payments. In evaluating the options to protect some portion of their loans, the lenders had to consider the possibility that (…) an auction might produce no bidders and the lenders would need to have a Peruvian entity to bid if this turned out to be the case”, said Spoor.

“There is nothing unusual about a lender preparing for a worst case before it actually happens”, added the CEO.

The awarding of Ocho Sur’s assets in 14 July 2016 reached 62 million dollars, as announced by the Hernández & Cía law firm on its website.

From then on, the offshore mechanism acted fast, so fast that Peruvian Palm Holdings registered a capital increase of 55 million dollars in Bermuda’s public registries that same day. The speed was such that one of the forms submitted was dated 13 July, one day before the awarding. Five days later, the capital increased once again from 55 to 60 million dollars.

But lands did not come alone, but more money did too.

A document kept in Bermuda’s Registrar of Companies, to which Convoca.pe had access indicates that, after the awarding of the 223 oil palm plots to its subsidiaries, Peruvian Palm Holdings requested a new loan -just as United Oils used to. To do so, notes were issued in favour of “purchasers” again represented by SH UOL Administrative Agent Ltd., linked to The Kattegat Trust. It amounted to 35 million dollars.

Neither Anholt nor Spoor answered if this loan was completely assumed by Anholt Group.

Fixed and Floating Charge by ConvocaRedes on Scribd

A security over the assets of Peruvian Palm Holdings was executed in October 2016.

In any case, the assets of Peruvian Palm Holdings -Ocho Sur and the plantations being questioned― were encumbered as security against the failure to pay the 35-million-dollar loan.

The document of this new security is signed by Robet Decosimo, Anholt’s vice president, and by a relevant witness: Yumi Karlshoej, the youngest daughter of late Torben Karlshoej, whose patrimony belongs to The Kattegat Trust.

One of the questions that the business group refused to answer was whether the Karlshoej were aware of the criminal investigations carried out in Peru concerning the acquisition of lands and the installation of plantations that have changed owner many times.

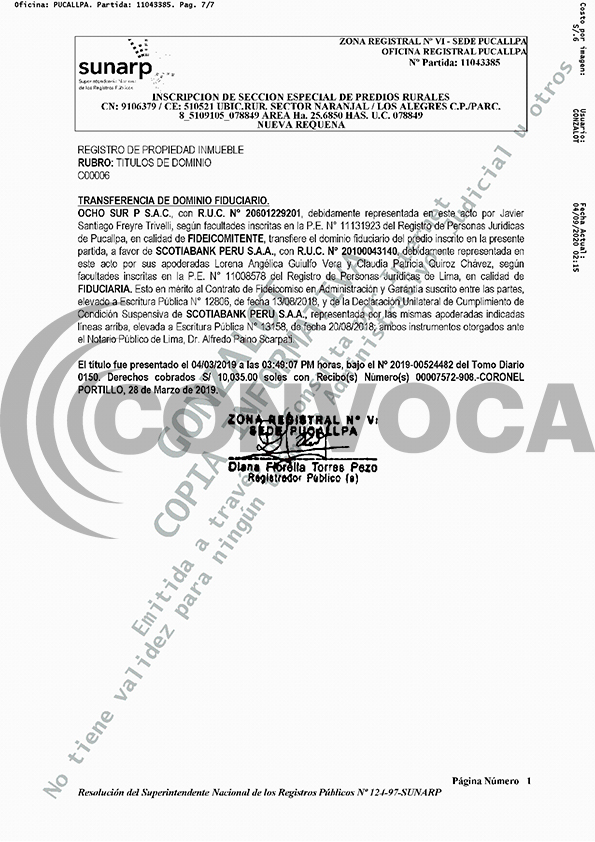

Convoca was able to verify the registry entries of some of Ocho Sur’s properties. They are still unseizable, but owned by another trustee. La Fiduciaria transferred the trust domain to Scotiabank Peru under a new security trust signed in August 2018.

Ocho Sur’s lands remained unseizable, but now under a new trust agreement signed in August with Scotiabank. Source: Sunarp

After cross-checking information, Convoca.pe has been able to identify a 48-million-dollar investment linked to Anholt made in the network of companies led by Melka and channelled through a chain of companies established in the tax haven of Bermuda.

Refuge in Bermudas

According to available registries in Bermuda, the directors of Peruvian Palm Holdings are currently six: James Bottiglieri, Robert Barton Decosimo and Rudolph Krediet, all three linked to The Kattegat Trust; Karl Schwarzfeld and Craig Tashjian, both linked to Amerra Capital, and Brett W. Hogan, director of the investment company Conti Street Partners located in Texas.

“They are the new owners, and the vision […] is completely different from that of those who started this project. There is no relation to Melka or any other person from the former group. This is managed from Connecticut, New York and Lima”, declared Karim Kahatt, Ocho Sur’s lawyer.

However, Convoca discovered that Dennis Melka -who is investigated by the Specialised Prosecutor for Organised Crime- appeared as the seventh director of Peruvian Palm Holdings until last year. This fact had already been exposed in November 2019 by Forest People Programme, but went unnoticed as there was no clear connection between the offshore company and Ocho Sur. This report has revealed that it is Ocho Sur’s owner.

Until 2019, Dennis Melka appeared as the seventh director of the Peruvian Palm Holdings, Ocho Sur’s owner, in the registries of Bermuda. Screenshot: Forest Peoples Programme.

In the past, the scandals that associated Melka and its companies with mass deforestation in the Peruvian Amazonia reached the Alternative London Investment Market (AIM), where shares of United Cacao Limited ―one of its companies that owned another 3 thousand hectares in Loreto― were listed. As a result, 60 NGOs and indigenous organisations from Peru, USA and Europe asked for its removal from the stock market, as it had failed to comply with its regulations. They claim that the financing placed in the stock market and the deforestation in Peru were connected.

The company was removed when its stock market representative resigned and United Cacao did not find another one to keep trading its shares.

Melka’s Response

Convoca contacted Dennis Melka through email to ask him about his participation in the recently created Peruvian Palm Holdings and Ocho Sur. He refused to make a statement because he was not “available” to declare to media that, according to him, promoted “the manipulation of the truth and a disgusting disregard for economic opportunity for thousands of Peruvians created by investors who come to Peru with a approved development project from the Peruvian authorities”.

In his answer, Melka avoided mentioning that he is being investigated by Peruvian authorities from the Public Prosecutor’s Office for not complying with the law during the execution of his project.

For his part, Michael Spoor declared: “As unintentional owners of the lands that they had been granted by La Fiduciaria, the owners of Ocho Sur engaged Dennis Melka to provide an understanding of the assets that they had received, but have ended that relationship”.

“Dennis Melka is now neither director nor shareholder of Peruvian Palm Holdings Limited (PPHL) and has no remaining relation, directly or indirectly, with Ocho Sur or PPHL”, he claimed. We asked him to elaborate his answer, but he suggested us to participate in a “multi-stakeholder dialogue process” including the communities of Ucayali instead. “That seems to me to be more productive than questions and answers via email […]”, he stated, even though we asked him for an interview.

On the other hand, Uchunya community’s lawyer, Álvaro Másquez, claimed that “based on this evidence [Melka’s presence], we believe that this company shares the same interests [of the former company], and the trust process to liquidate was a business strategy led by the company to avoid responsibilities”.

In December 2018―a year after it was requested―, a precautionary measure was ordered to stop “all depredatory activities” and machineries of Plantaciones de Pucallpa. When the Specialised Prosecutor’s representatives visited its premises, they were welcomed by Ocho Sur’s general manager, who ensured there were no relations with the company under liquidation. The precautionary measure could not be executed.

The civil redress requested by the Ministry of the Environment’s prosecutor for clear-cutting, when the lands belonged to the extinct Plantaciones de Pucallpa and Plantaciones de Ucayali, amount to 124 million dollars (436 million soles).

Meanwhile, Melka has travelled back and forth to Peru as usual, according to his immigration records. He was there 9 times in 2017, 10 times in 2018, and another 10 times in 2019.

Sources from the Public Prosecutor’s Office confirmed that towards the end of last year the American businessman finally sent back a document in which he acknowledged having received notice for the criminal association and clear-cutting investigation concerning Plantaciones de Pucallpa. This investigation goes back to 2015, but due to its complexity, it was moved from an environmental prosecutor in Pucallpa to the First Specialised Prosecutor for Organised Crime in Lima.

Dennis Melka did not respond to the questions sent by Convoca.pe about his businesses and investors, as he believes that reports informing of his operations in Peru go against a plan created by investors to benefit thousands of families. He chose to be quite about the fact that he is under investigation for massive deforestation.

Repetitive Names

In addition to Dennis Melka’s, many other names involved in the deforestation investigation are shared by the former management and Ocho Sur’s new one, no matter how hard the latter tries to distance itself from the former.

This is the case of the executives from TMF Group, an international provider of business administration services. Its executives Javier Gerardo Grau Sáez, Esteban José Hilgert and Jorge Luis Torres Garay have represented both the Melka Group and Ocho Sur group. All three, alongside Melka, are currently under a prosecutor’s investigation for crimes against forests in Tamshiyacu, Loreto, related to United Cacao Limited.

Nonetheless, the most controversial character is Alfredo Rivera Loarte, who is also under investigation along with Melka for the deforestation generated in the lands that are now occupied by Ocho Sur. Rivera appeared as legal representative of the now liquidated Plantaciones de Pucallpa and Plantaciones de Ucayali.

Despite this background, Rivera was listed in April 2017 as the new legal representative of Ocho Sur P and Ocho Sur U, and in 2018 of the youngest and smallest company of the Group: Servicios Agrarios de Pucallpa SAC, with which the Group managed by Anholt attempts to industrialise the business and produce palm oil.

In 2018, Covoca.pe discovered that “sustainable” palm oil companies purchased palm oil fruits from Ochoa Sur.

“None of the people that you mention are currently employees or part of the administration of Ocho Sur” replied Spoor. “However, when the company was granted the land by La Fiduciaria, it was useful to listen to people that lived in that area and that had knowledge about the operations and the cultivation process”, he claimed.

“Upon assuming ownership of the land, it [Ocho Sur] immediately launched a global search for a world class management team. Once the new team was assembled and had established its new policies and strategies, the company severed ties with the former UOL employees you mention”, he noted.

Meanwhile, Servicios Agrarios de Pucallpa has already prepared an Environmental Impact Assessment to operate a palm oil processing plant. During the approval process, they needed to allocate a plot of land for the project implementation, which is why they had to resort to the old Plantaciones de Pucallpa.

We had access to a hasty lease agreement on part of the land entered into on 17 October 2017 between Servicios Agrarios de Pucallpa, owned by Peruvian Palm Holdings, and Plantaciones de Pucallpa, owned by the Melka Group. It was executed three weeks before it was submitted to Peru’s Ministry of Production, among other procedures carried out to obtain the environmental approval.

In this context, the agreement had no point, considering that the 45-hectare plot -as we verified- was part of the land already awarded a year before by La Fiduciaria to Ocho Sur, and was registered in September 2017.

So, why sign the land leasing agreement with the Melka Group’s company?, we asked Ocho Sur’s CEO. “Servicios Agrarios de Pucallpa is a company that owns a palm oil extraction mill that was constructed in 2019 and 2020 on land that it leases from Ocho Sur P. I don’t know of any relation that it has with Plantaciones de Pucallpa or of any other relations between Ocho Sur and the entities that owned the lands prior to them”, claimed Spoor.

Contrato Plantaciones de Pucallpa y Servicios Agrarios de Pucallpa (1) by ConvocaRedes on Scribd

Ocho Sur declared to the Ministry of Production to have a lease agreement with Plantaciones de Pucallpa.

But there are more connections. In the contact information submitted by Servicios Agrarios de Pucallpa to the Ministry of Production, Javier Freyre Trivelli then General Manager of the company and legal representative of Peruvian Palm Holdings appeared as representative. However, the email address provided belonged to Julio César Rivera Meza, Melka Group’s former worker, and the domain was palmasdelperu.com. According to the Domain Tools app, this Internet domain was registered by East Pacific Capital Limited, a company whose sole owner was Dennis Melka.

We tried to reach Mr. Freyre by phone to the number provided to the authorities, but the line was deactivated.

The Offshore Trust Empire

Trusts have not only been used by Ocho Sur group, but they also are a long-standing common practice in the controlling group of companies. This legal mechanism allows certain assets, that become unseizable, to be managed by others for the benefit of third parties.

In 1973, Danish Torben Karlshoej (1942-1992) founded Teekay Corporation, a marine transportation company that began by transporting oil in tankers from Indonesia. Today, it is listed on the New York Stock Exchange and has become one of the world’s most important commercial groups in this industry, managing through its subsidiaries assets valued at 11 billion dollars, including a robust fleet of 154 vessels. But not always has the tycoon had the wind at his back.

In 1991, with the oil crisis resulting from the Golf War, Karlshoej -overindebted and on the verge of bankruptcy- secured his assets using the trust system. He managed to create several trusts before his death a year later in 1992.

The Kattegat Trust in 2007 was later conceived from this group of trusts. According to different statements made by its companies to the Securities and Exchange Commission (SEC), the regulatory agency of financial markets in the United States, this is a charitable trust “committed to the core business of distributing income to charitable causes”.

The fact is that The Kattegat Trust partakes through its subsidiaries in very profitable businesses.

For instance, it is the majority shareholder of two companies listed on the New York Stock Exchange. The abovementioned Teekay Corporation is one of them, with the Kattegat Trust owning 31.7% of its common shares through its subsidiary Resolute Investments Ltd. from Bermuda. The other company is Compass Diversified Holdings, founded with trust assets in 1998, where The Kattegat Trust owns 14.1% of its common share through its affiliate CGI Diversified Holdings LP. Anholt is an indirect beneficiary, according to SEC reports.

Out of the public eye of the stock exchange, their investments spread even more thanks to the large fleet of corporations incorporated along the same Bermuda Islands. The trustee of this charitable trust is Kattegat Private Trustees (Bermuda) Ltd., which splits into all the branches of subsidiaries, including those of the Anholt group.

The trustee directors are officers from the offshore consultancy firms Moore Global and MJM Barristers & Attorneys.

But the company at the top of the hierarchy of this economic group -where the name Karlshoej comes up once again- is the trust protector of this charitable trust: Path Spirit Limited, who monitors that the assets are properly managed by the trustee.

Path Spirit Document. Trusts by ConvocaRedes on Scribd

Bylaws of the charitable trust protector: Path Spirit Limited.

Path Spirit’s bylaws, approved in 2006, have a “family” structure. For example, they point out that Path’s Board must be comprised of at least two directors from the Karlshoej family (one senior and one junior) and two directors not related to the family.

The current directors are the Danish Axel Karlshoej -older brother of the late tycoon- and Svend Erik Kjaergaard, as well as the Briton Mathew Gibbons.

Other trusts related to this company from London are Viking Trust, The Heritage Discretionary Settlement, and TK Foundation.

As of March 31, 2019, Path Spirit’s financial statements showed a humble figure of 20,785 pounds for net assets. The real fortune of this shipowner giant is safely anchored in trusts spread alongside the Atlantic coast, and now we know that it even has connections to Peru.

SELLO 2019. Path Spirit. Assets (1) by ConvocaRedes on Scribd

Path Spirit Limited’s financial statements.

Menú

Menú

Buscar

Buscar

Sé el primero en leer nuestras publicaciones

Sé el primero en leer nuestras publicaciones